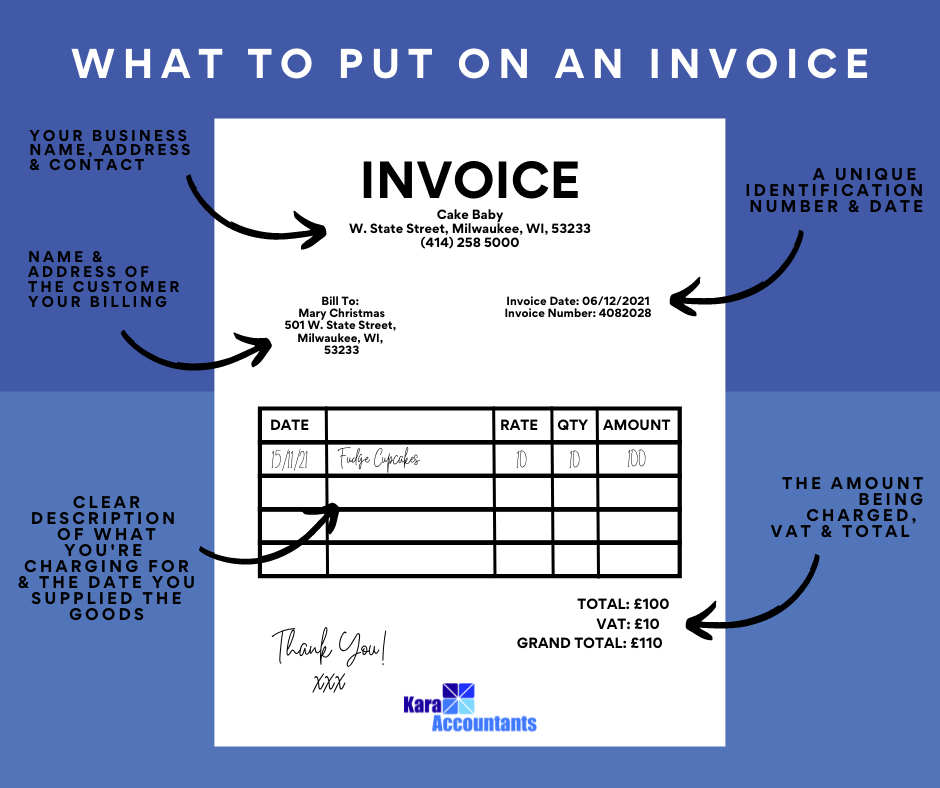

Invoice Checklist: What You Need To Include On Your Invoice

As a new business or freelancer, sending an invoice may feel like unchartered territory. But if you sell a product or service, you are required by law to give your customers an invoice. And before you ask, no, an invoice is not the same as a receipt.

A receipt is an acknowledgement of payment whereas an invoice is a bill. An invoice will be required to have certain information on it. Here’s a breakdown of what you’ll need to include.

A Unique Identification Number: Create one to make it clear what transaction this will be for, both for you and the client’s records.

Your Name, Address & Contact Information: Make it clear who has created the invoice by stating your name or your business’s name and address on the document. If you’re a limited company, you need to put the full name of the company as it appears on the certificate of incorporation. If you decide to put any directors’ names on the invoice, you must include all directors.

The Company Name and Address of The Customer You’re Invoicing: Make it clear who is being billed.

A Clear Description Of What You’re Charging For: Note down the product or service that you provided to the client.

The Date The Goods Or Service Were Provided: Note the date you supplied the goods to the client.

The Date Of The Invoice: Note on the document the date that the invoice was sent.

The Amount Being Charged: Make sure it’s clear what is being charged.

VAT Amount: Include the VAT amount if applicable.

The Total Amount Owed: Ensure that the total amount including tax is clear on the invoice. Make sure it stands out so they won’t get confused by any other figure.

These are all the things you need for a basic invoice. If you and the client are VAT registered, you need to create a VAT invoice that will include more information than non VAT invoices. As long as all the above information is clear and stated on the document, you’re free to get your design freak on and use your own brand colours and illustrations.

This Post Has 0 Comments